Plasma Deep Dive: High‑Performance Layer 1 Blockchain Designed for Stablecoins

1. Background and Overview

Source: https://www.plasma.to/

Stablecoin Market and Demand: Stablecoins are one of the few areas in the blockchain space that have achieved product-market fit (PMF), and are widely used in global daily payments and cross-border remittances. However, general-purpose chains like Ethereum have high transaction fees and limited throughput, which doesn’t fully match specific application needs.

Plasma Project Positioning: Plasma is a high-performance Layer1 blockchain optimized for stablecoins, originating from Bitcoin sidechains and compatible with the Ethereum Virtual Machine (EVM). It aims to provide zero-fee USDT transfers and high throughput. Its core goal is to reduce the cost of stablecoin circulation on-chain, improve processing efficiency, and provide an underlying settlement network for daily stablecoin usage scenarios (such as on-chain transactions, cross-border remittances, and merchant settlements).

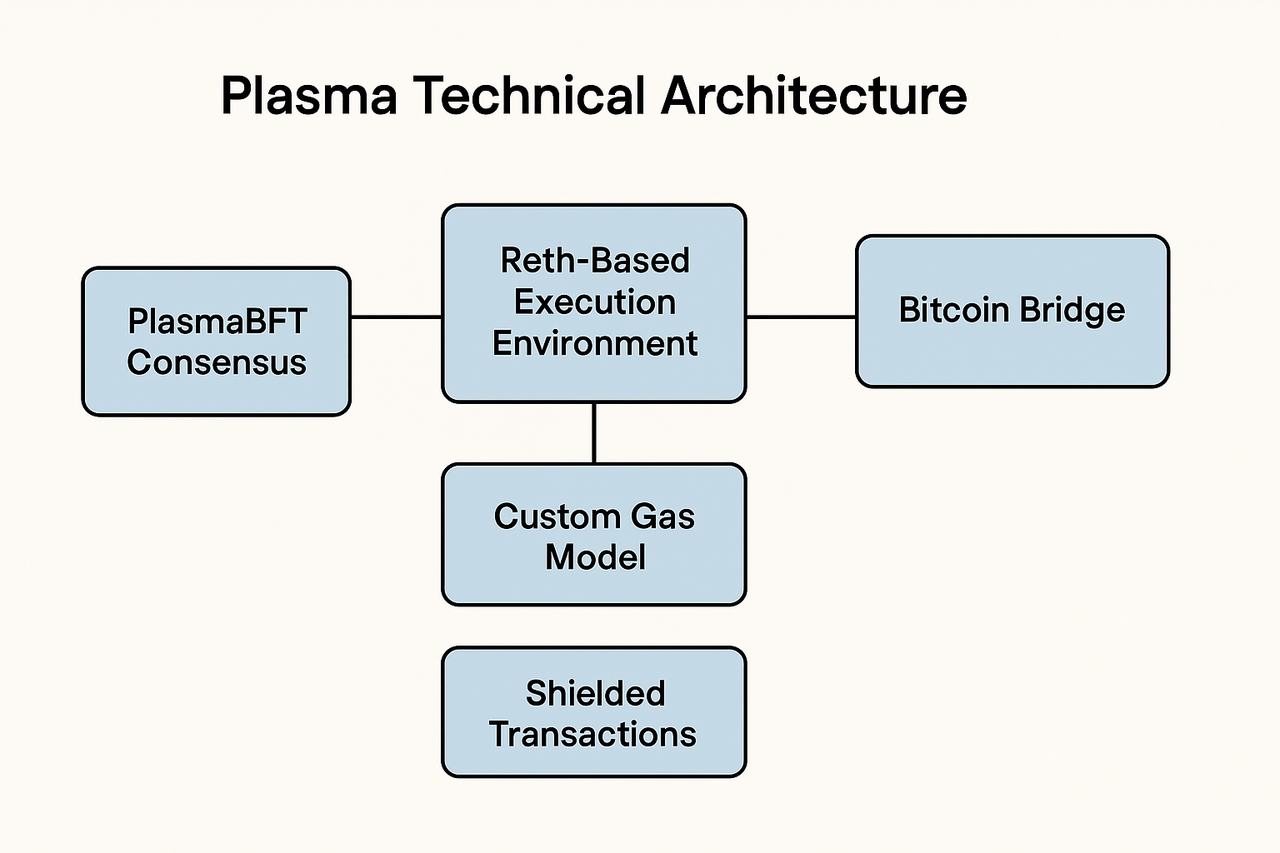

Key Features: Plasma has built its own network architecture, including PlasmaBFT consensus, Reth-based execution environment, custom Gas model, zero-fee stablecoin channels, and private transactions. Additionally, the project has received support from well-known institutions such as Bitfinex, Founders Fund, and Framework Ventures, and is actively building a stablecoin ecosystem through collaborations with stablecoin projects (like Ethena and USDT0) and fintech companies (such as Yellow Card).

2. Technical Architecture

2.1 PlasmaBFT Consensus Mechanism

Plasma uses its own developed PlasmaBFT consensus algorithm (an improved version based on Fast HotStuff), simplifying the consensus process to two phases (prepare and pre-commit), and introducing pipeline-style parallel processing to achieve high-concurrency consensus.

PlasmaBFT achieves sub-second transaction finality and supports processing thousands of transactions per second in a single-chain architecture (team data shows it can exceed 2000 TPS). This BFT consensus provides fast finality and high security for the network, offering higher throughput compared to Ethereum’s PoS validation mechanism.

2.2 EVM Compatible Execution Environment

The execution layer is based on the Reth client (a Rust implementation of the Ethereum execution client) developed by Paradigm, featuring modular architecture, memory safety, and high performance. Plasma’s execution environment is fully compatible with Ethereum (Solidity smart contracts can be deployed directly), supporting development tool chains like MetaMask and Hardhat.

Developers can reuse existing Ethereum ecosystem code and contracts, simplifying migration work. Plasma balances Ethereum’s account model and Bitcoin’s UTXO model (can support paying Gas fees with Bitcoin) to achieve a flexible payment and settlement experience.

2.3 Native Bitcoin Bridge

Plasma regularly submits on-chain state root hashes to the Bitcoin main chain for secure anchoring. Plasma validators running Bitcoin nodes can verify Bitcoin blocks and transactions. When users send BTC to the bridge address, validators detect and issue an equivalent amount of wrapped BTC (wBTC) on the Plasma chain. When redeeming, threshold Schnorr signatures are used to release BTC on the main network.

This design leverages Bitcoin’s security and decentralization, providing Plasma with Bitcoin-like finality and auditability without changing the Bitcoin protocol. In the future, Plasma plans to integrate new technologies like BitVM, OP_CAT, and ZKP to further enhance the bridge’s security and decentralization.

2.4 Customized Gas Model

Plasma supports paying transaction fees with multiple tokens: users can use the native token XPL or whitelisted assets (such as USDT, BTC) to pay for Gas. If non-native tokens are used for payment, on-chain oracles will exchange them for XPL at market prices to pay fees.

The system introduces a dual-channel transaction mechanism: the network is divided into “fee-rate transaction channels” and “free transaction channels,” processing transactions with different strategies in parallel. Stablecoin transfers can choose to enter the free channel (no fees required), while time-sensitive transactions use the priority channel and pay XPL for acceleration. Through adaptive delay-based prioritization, users can choose between “slow and free” or “fast and paid” options.

2.5 Privacy Payment Module

Plasma is researching the introduction of shielded transactions on-chain, hiding transaction history, recipients, senders, and amounts to protect user privacy.

Considering financial compliance requirements, Plasma’s design may include selective information disclosure functionality: transaction details can be opened for regulatory audits while protecting user privacy by default. This privacy module is similar to the technology of privacy coins like Zcash but needs to balance scrutiny and regulation.

2.6 Other Technical Features

Highly scalable architecture design: Plasma accelerates node synchronization and parallel processing to improve performance through Reth client’s modularity and phased synchronization.

Tool support: Subsequent launch of stablecoin-oriented APIs, SDKs, and other infrastructure (roadmap mentions phased rollout of native tools) to simplify application development and integration.

Plasma Technical Architecture Diagram (Source: Gate Learn Creator Max)

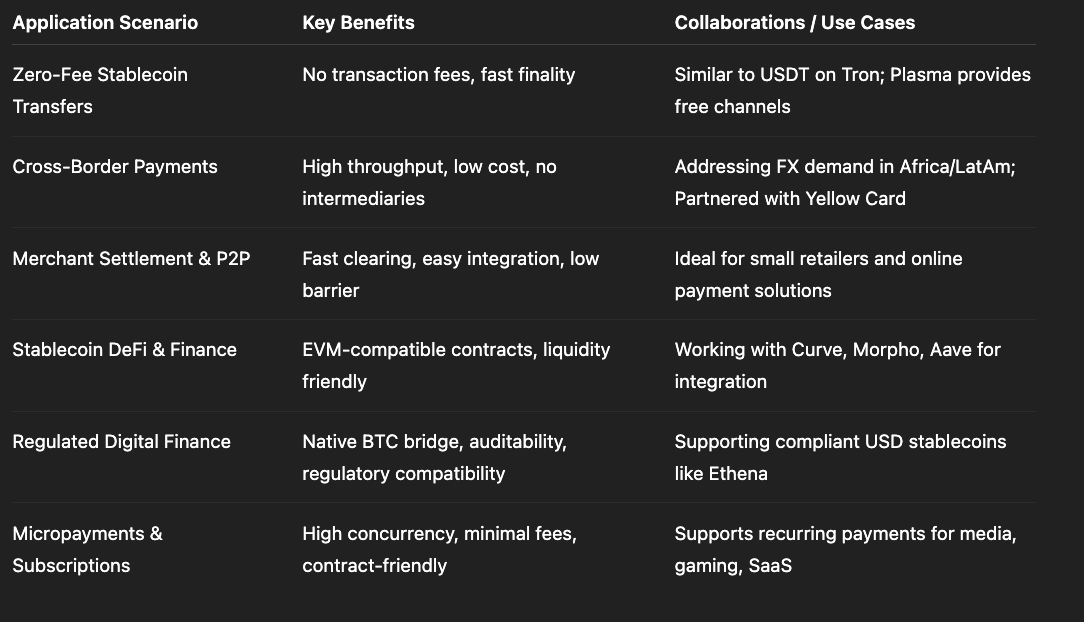

3. Application Scenarios

Plasma Application Scenarios Table (Source: Gate Learn Creator Max)

Zero-fee Stablecoin Payments: Plasma caters to daily stablecoin payment scenarios, providing a seamless experience similar to peer-to-peer payments and merchant settlements. With the free USDT channel, users can achieve fee-less USDT transfers on Plasma (referencing Tron’s large-scale USDT usage case), reducing user costs and enhancing experience.

Cross-border Remittances and International Payments: In regions with unstable currencies (such as Africa and Latin America) and areas under economic sanctions, stablecoins are widely used for value storage and remittances. Plasma can serve as a cross-border payment network, leveraging its high throughput and low-cost advantages to support global stablecoin transfers, addressing remittance bottlenecks in traditional channels.

Compliant Digital Finance: Plasma is collaborating with projects like Ethena (decentralized US dollar stablecoin) to launch localized, compliant versions of stablecoins. Its infrastructure is suitable for financial institutions; for example, banks and payment companies can quickly integrate stablecoin payments and settlements through Plasma’s settlement API, promoting the application of stablecoins in mainstream financial systems.

Merchant Settlement and Micropayments: Leveraging high throughput and low costs, Plasma can provide fast payment and settlement services for merchants. For instance, Yellow Card, Africa’s largest stablecoin infrastructure provider, will use Plasma’s free USDT transfers to help merchants process peer-to-peer payments. Additionally, smart contracts can support micropayment businesses based on stablecoins, such as installment payments and subscriptions.

Stablecoin DeFi and Ecosystem: Plasma plans to deploy various stablecoins and DeFi protocols. It has communicated with multiple DeFi projects like Curve, Maker, Aave, and Morpho for integration, providing users with services such as stablecoin exchange, lending, and yield farming. Leveraging EVM compatibility, existing DeFi contracts can be quickly migrated, forming a rich stablecoin financial ecosystem.

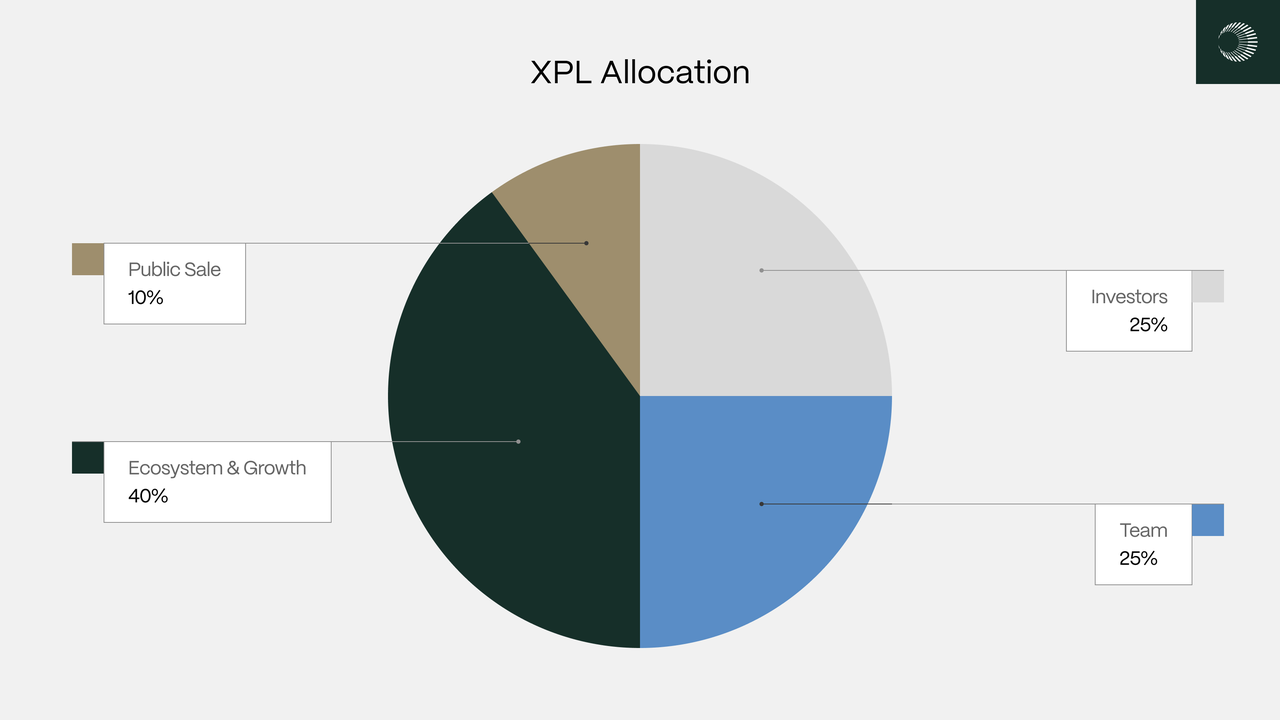

4. XPL Economic Model

4.1 Issuance and Distribution

Source: https://docs.plasma.to/docs/get-started/xpl/tokenomics

The total supply of Plasma’s native token XPL is 10 billion. During the mainnet public sale phase, 10% (1 billion) was issued for investor purchase at a price of $0.05 per token, corresponding to a fundraising target of $50 million.

Token subscriptions were made by depositing USDT/USDC/USDS and other stablecoins into the Plasma Vault on the Ethereum chain for staking allocation. The final subscription amount reached $500 million, double the target (deposit of about $500 million, including ~$345 million USDC, ~$146 million USDT), demonstrating investors’ high recognition of the project’s vision.

4.2 Lock-up Mechanism

To ensure fairness and stability, the deposits from token sales were locked starting July 14, with participants required to lock up for at least 40 days after the subscription ends. US investors have a longer lock-up period of 12 months to comply with local regulatory requirements. Users from the UK and some restricted regions were excluded from participation.

This lock-up mechanism limits circulation in the short term, reducing speculative risks and improving early network stability.

4.3 Inflation and Distribution (Expected)

Plasma has not yet disclosed a complete inflation plan. However, referring to models of other high-performance public chains (such as Avalanche, Cosmos), there is usually an annual inflation set (to reward validators and support ecosystem building). Plasma may explain the annual inflation rate and distribution mechanism of XPL in subsequent releases.

XPL holders may use tokens to pay transaction fees (Gas) and participate in network governance, helping to form intrinsic value demand.

4.4 Staking and Governance

Plasma adopts a Proof of Stake (PoS) model, where XPL can be used for validator node staking, ensuring network security. Stakers will receive transaction fees and block rewards as returns, similar to the mechanisms of Ethereum or Avalanche.

XPL tokens are also expected to have governance functions, allowing holders to participate in on-chain proposals and voting, deciding on protocol upgrades and fund usage (similar to the governance roles of tokens like ARB and OP). Specific governance mechanisms and voting weight systems are yet to be announced by the project team.

5. Industry Comparison

5.1 Other Layer1 Blockchains

Ethereum: The earliest large-scale smart contract platform with the richest ecosystem and relatively high security guarantees. However, its base network throughput is only about 15 TPS, and transaction fees can reach tens of dollars during peak periods, unsuitable for high-frequency, small-amount payments. Ethereum’s Layer2 solutions can reduce fees but still rely on its mainchain security and settlement speed.

Solana: Designed for extreme performance, with a theoretical peak TPS of 65,000 and an actual mainnet average of 2,000-3,000 TPS; extremely low transaction fees (about $0.00025). The downside is centralization degree and network stability issues (has experienced multiple outages). Solana is a non-EVM platform (using Rust/Solana VM), incompatible with the Ethereum ecosystem.

Avalanche: Adopts a multi-chain architecture (X-Chain, C-Chain, P-Chain) to achieve high performance, with C-Chain compatible with EVM. Typical TPS can reach thousands (about 4,500 TPS), confirmation time less than 1 second, and low transaction fees (about $0.08). Avalanche provides customizable subnets, offering high flexibility; but its ecosystem scale and number of validator nodes are relatively fewer compared to Ethereum.

Compared to these general-purpose public chains, Plasma focuses on stablecoin scenarios. It combines Bitcoin’s security and Ethereum’s programmability, optimizing stablecoin transfer experience through zero fees and high throughput features. Traditional public chains often cannot simultaneously satisfy low fees and high concurrency. Plasma’s introduced dual-channel zero-fee structure and Bitcoin anchoring are its differentiated advantages.

5.2 Layer2 Scaling Solutions

Optimism, Arbitrum (Optimistic Rollups): Both are Ethereum Layer2 scaling solutions that significantly increase throughput and reduce fees by moving most transactions off-chain and periodically submitting data to the Ethereum mainnet. They are fully compatible with EVM, supporting Ethereum contract migration to Layer2. Security relies on Ethereum: transactions are initially assumed valid, with a “fraud proof” mechanism activated if disputes arise. Currently, Arbitrum has higher total locked value and transaction volume than Optimism (Arbitrum TVL about $15.94 billion, throughput about 5.9 TPS; Optimism TVL about $9.36 billion, throughput about 3.8 TPS). Both issue governance tokens (ARB, OP) and do not provide free transaction mechanisms, still requiring Ethereum Gas consumption.

ZK Rollups: Including zkSync, StarkNet, etc., utilize zero-knowledge proof technology to package transactions off-chain and submit validity proofs to Ethereum. Features include faster finality (no challenge period required) and stronger security, but the computational cost of generating proofs is higher, currently mainly supporting EVM compatibility versions. ZK Rollups can provide higher throughput and instant settlement in stablecoin scenarios, but ecosystem and developer support are still growing.

Plasma vs Layer2

As an independent Layer1 blockchain, Plasma’s security model and finality differ significantly from Layer2. Layer2 relies on Ethereum as a fallback, needing to wait for fraud proof periods or proof generation; while Plasma uses BFT consensus, allowing real-time block confirmation. Plasma anchors its state to the Bitcoin network rather than Ethereum, meaning Plasma is not affected by Ethereum network congestion. Additionally, Plasma provides zero-fee stablecoin channels, a feature most Layer2 solutions lack.

5.3 Key Points of Performance and Design Comparison

Throughput: Plasma can process thousands of transactions per second (aiming to exceed 2000 TPS). In comparison, Ethereum mainnet is about 15 TPS, Solana consistently about 2000-3000 TPS, Avalanche C-Chain about 4500 TPS, Optimism and Arbitrum currently at single-digit TPS levels.

Cost: Plasma offers fee-free stablecoin transfers; Ethereum mainnet fees can exceed tens of dollars during peak times, Solana transaction fees are negligible, Avalanche about $0.08. Layer2 requires Ethereum Gas payment, usually lower than Ethereum mainnet but not completely free.

Ecosystem Compatibility: Plasma is compatible with Ethereum (Solidity contracts can be deployed directly), developer-friendly; Solana ecosystem is independent; Avalanche supports multi-chain but requires using C-Chain; Layer2 fully inherits Ethereum ecosystem.

Security and Decentralization: Plasma uses Bitcoin as a security foundation (sidechain anchoring), enjoying Bitcoin’s security and decentralization advantages; Ethereum uses PoS, high security; Solana faces significant centralization controversy; Avalanche has a multi-chain architecture but smaller node scale than Ethereum; Layer2 inherits Ethereum security.

Application Positioning: Plasma clearly serves stablecoin payment scenarios, not focusing on complex functions like NFTs or games, resulting in a lightweight, efficient architecture. In contrast, other chains have diverse functions but may deviate from stablecoin circulation needs.

6. Summary and Outlook

Plasma’s Positioning and Potential: Plasma aims to create a specialized public chain for stablecoins, attracting large-scale stablecoin applications with high performance and zero fees. This positioning currently has few precedents, similar to the “Everything Bagel” metaphor in the movie “Everything Everywhere All at Once” - an all-encompassing stablecoin infrastructure. With close relationships with Tether’s parent company and founders, numerous ecosystem partners (Ethena, USDT0, Yellow Card, etc.), and leading technical architecture, Plasma has the potential to become a crucial infrastructure in the stablecoin market.

Currently, Plasma is still in its early stages, with the mainnet not yet officially launched. Its technical implementation and ecosystem attractiveness await market validation. The key lies in whether it can quickly attract developers and users after the mainnet launch, establishing network effects for the stablecoin settlement network. Meanwhile, regulation and security need continuous attention, especially balancing privacy transactions and compliance.

Future Outlook: As stablecoin demand continues to grow, the necessity of having specialized chain infrastructure becomes increasingly prominent. Plasma’s innovative approach and strong supporter lineup make it a project worth watching. In the future, whether Plasma can deliver on its promise of zero-fee high performance, and how it will compete for a place in the multi-chain coexistence landscape, will be key points of observation.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

Top 10 NFT Data Platforms Overview

7 Analysis Tools for Understanding NFTs

What Is Technical Analysis?

What is Tronscan and How Can You Use it in 2025?